https://seekingalpha.com/article/4481138-crashing-without-a-net

Summary

- As the Fed buys bonds, they are printing money and driving up the price of bonds.

- As bond prices come down, stock prices will also come down.

- With interest rates already at 0%, the Fed cannot lower them anymore.

It ain’t what you don’t know that gets you into trouble, it’s what you know for sure that just ain’t so.”

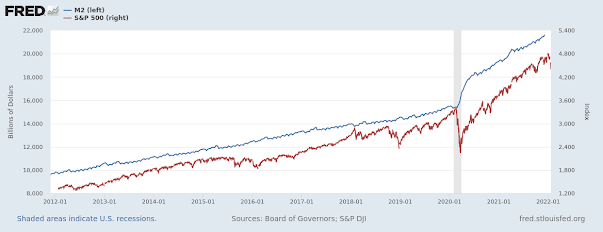

Today people “know for sure” that the more money the Fed prints the more the stock market goes up. Using FRED Graph we can make the following:

With this view people may think that the Fed can always print money and always make the stock market go up, but this just ain’t so and will get them in trouble.

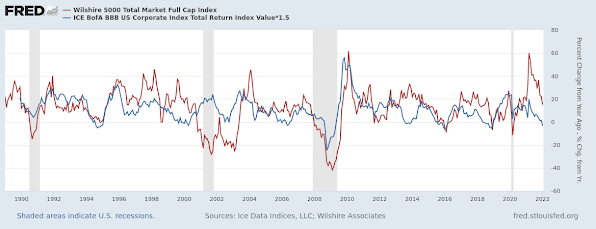

A more accurate way to think about it is that stocks are correlated to long-term bonds but a bit more volatile (here we use 1.5 factor). This FRED Graph shows this:

The Fed can often manipulate the bond market by buying/selling bonds and adjusting the Fed Funds rate. As the Fed buys bonds, they are printing money and driving up the price of bonds (and lowering interest rates). The stocks go up as the bonds go up. So, often the Fed printing money does make the stock market go up, but again that is too simple a way of thinking about it and will get you in trouble.

The trouble comes when inflation comes, as it has now. By law, the Fed has to fight inflation. The way to fight inflation is by not printing so much money. If they are not printing so much money, then they are not buying so many bonds, so bond prices will come down. As bond prices come down, stock prices will also come down.

The famous Fed Put is where the Fed steps in and stabilizes markets. This does not work when there is high inflation and interest rates are already at 0%. In the previous market crashes the Fed could lower interest rates and so make bond prices and stock prices go up. However, with interest rates already at 0%, the Fed cannot lower them anymore. Bonds are already at historic highs, so they cannot be driven up any higher. High inflation tends to push bond interest rates up and so make bond prices go down. In previous market crashes, inflation was low so the Fed was cleared to print money. Today, we have high inflation, so the Fed’s hands are tied. The Fed Put has expired.

In previous crashes the Fed was able to step in and halt a crash, making for a quick bounce back. Current investors believe the “Fed has their back”, but this just ain’t so. Today, we are crashing without a net. This crash will probably be worse than anything in recent memory.

PS. Powell understood the danger of low interest rates making the current bubble and yet did it anyway. Here is Powell from 2016:

…it’s plausible to me that rates will have to remain very low for a very long time to achieve stable prices and full employment, but that such low rates will drive excessive credit growth and create irresistible upward pressure on asset prices, including real estate prices. I’m thinking of a situation in which a broad range of asset prices are moving up well beyond what fundamentals would justify; where the other tools we have don’t seem to be addressing the problem or have failed to do so; and where low interest rates are pushing up asset prices and driving credit to excessive levels, probably over many years, and thus are a principal cause of the threat. Recalling that we have had two major real estate blowups in the past 25 years…”

Original Post https://buy.tinypass.com/checkout/template/cacheableShow?aid=CWJjPp7cpu&templateId=OT0M2WOK1CO8&offerId=fakeOfferId&experienceId=EXWTEW4YENQ8&iframeId=offer_331476d329d9c0dd6119-0&displayMode=inline&widget=template&url=https%3A%2F%2Fseekingalpha.com

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.