Only real market nerds will likely remember when analysts from Sanford Bernstein provoked an intense debate on Wall Street (and finance twitter) by publishing a memorable note warning that passive investing would eventually prove to be worse for society than communism.

Source: FT

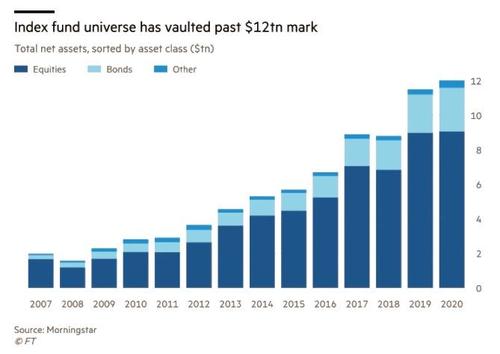

The trend has enriched ETF giants like BlackRock. But it’s also been a boon for the creators of the indexes themselves. Players like MSCI, formerly a unit of Morgan Stanley, and FTSE Russell (along with their more famous American peers like S&P Dow Jones) have made a killing from the fees generated by asset managers licensing their indexes to help them manage trillions of dollars in capital.

Now, the FT reports that MSCI and its rivals are scrambling to beat their competitors to realize a new innovation: what the FT described as the culmination of “half a century of academic theory”.

Specifically, they’re working on an “ultimate index” that would track the performance of all markets, including opaque venture-capital and private equity and futures-dependent commodities. The result would be an all-in-one, ‘set-it-and-forget-it’ fund to which investors could safely allocate their entire (or almost their entire) portfolio.

According to the FT, Peter Shepard, head of analytics research and product development at MSCI (which is one of the indexing industry’s Big Three indexers, alongside FTSE Russell and S&P Dow Jones Indices) has been working on producing an index of this kind for more than a decade. He thinks he is getting close, although he is reluctant to term the final result an “ultimate index”. A former theoretical physicist, Shepard once spent his days working on the “grand unified theory of physics”.

However, Shepard believes finding a “grand unified theory of markets” might be even more complicated.

Before he joined MSCI in 2007, Shepard was a theoretical physicist at Berkeley — his PhD thesis was titled On non-perturbative quantum gravity: Holography and matrix models in string theory — and he spent much of his time chasing the holy grail of physicists, a unifying Theory of Everything. He is therefore wary of applying the same label to the realm of indexing.

I need to be careful about not falling into that trap again,” he said. “I think we may be able to find a grand unified theory of physics at some point, but we’re not going to be able to find a grand unified theory of markets.” The standard investment industry benchmark has long been the 60/40 portfolio — 60 per cent stocks and 40 per cent bonds. Vanguard’s US 60/40 fund has returned 168 per cent over the past two decades. Yet what to include in a broader index is hotly debated, and how to construct it is fraught with practical complications in sourcing reliable up-to-date data in areas like private markets.

As Shepard tries to determine the best mix of assets for the broad-based fund, financial advisors fear that a universal all-in-one fund could be the next step in the battle to drive investment fees to rock-bottom levels.

While the cost of investing in individual asset classes has been hammered down thanks to the invention of index funds, deciding on how to mix them is often handed over to a pricey financial adviser, or in the case of a pension plan, to a team of expensive professionals. If one could assemble one broad investable benchmark for all assets – a true reflection of what Sharpe termed “the market portfolio” back in the 1960s, rather than a messy or facile proxy – then one could perhaps create a single, simple financial product suitable for most investors.

In fact, financial advisors, who typically charge high fees without adding much value, could finally be driven into extinction by such a fund.

“I think there’s a huge opportunity here,” Shepard said. “The asset allocation decision is the most important decision for a lot of investors …But we’re leaving this really critical decision to people who may not be that skilled, like my parents, or they turn it over to someone who charges fees for it.”

Ultimately, Shepard believes a few different “flavors” of these universal indexes will be offered by companies like MSCI, and subsequently BlackRock, State Street and other ETF giants will jump at the opportunity to package them into products for sale to retail investors – who may or may not have the slightest clue about what they’re buying.